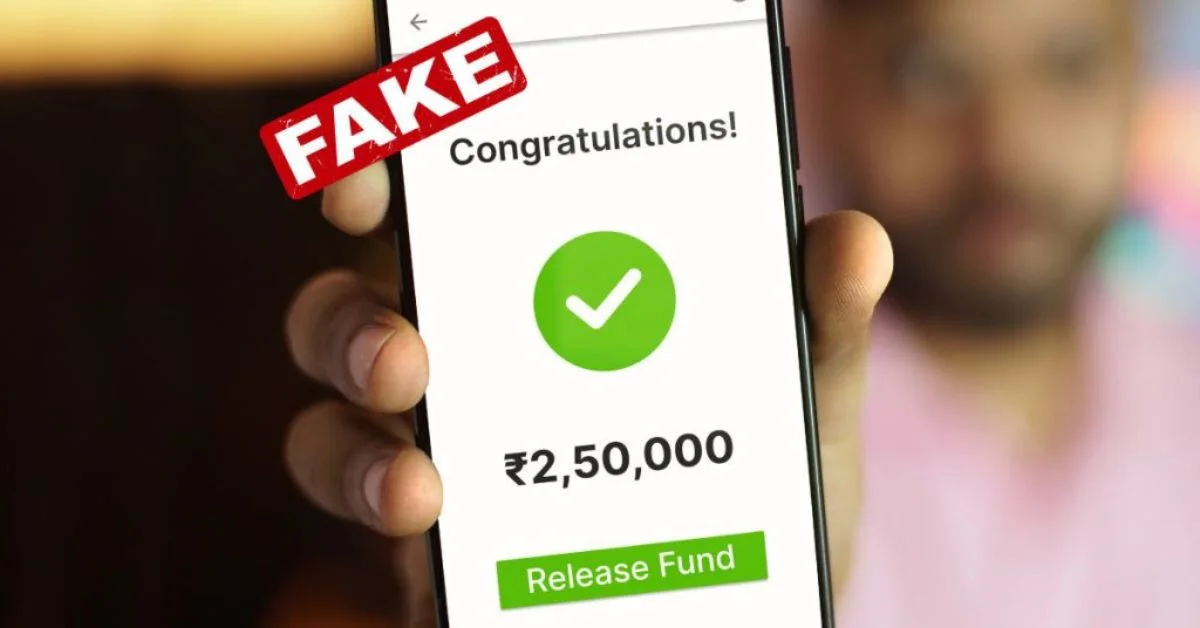

We all know how the fake loan apps and the online scammers harass people. The ill-effects of taking loans from apps not recognised by the RBI is known to all.

Even after so much of awareness being created, people still fall pray to such online scams, mainly because of our vulnerability.

Protecting oneself from fake loan apps and subsequent harassment requires a combination of caution, research, and proactive measures.

Here are some steps you can take:

Research The Lender Ar App:

- Always research the lender or loan app before applying for a loan. Look for online reviews, ratings, and user experiences.

- Check to see if the lender has a registered and issued license by the appropriate financial authorities in your nation.

Check Permissions:

- When installing a loan app, check the permissions it requires. Be wary of apps that ask for excessive permissions, such as access to your contacts, messages, or location, unless it's necessary for the app's legitimate functionality.

Read The Terms And Conditions:

- Carefully read the terms and conditions of the loan application. Be cautious of apps that have complex or unclear terms.

Avoid Upfront Fees:

- Legitimate lenders generally don't ask for upfront fees before providing a loan. Be sceptical of apps that ask for processing fees or advance payments.

Secure Your Personal Information:

- Never share sensitive personal information like Social Security numbers, bank account details, or passwords unless you are sure about the app's legitimacy.

Use The Official App Stores:

- Download apps only from official app stores like the Google Play Store or the Apple App Store. These platforms have some level of screening to prevent fake apps.

Check Developer Information:

- Look at the developer's information on the app store to ensure it's a reputable company.

Check Contact Information:

- Verify the lender's contact information, including phone numbers, addresses, and customer support details.

- Fake loan apps may have inconsistent or incomplete contact information.

User Reviews And Ratings:

- Check the app's user reviews and ratings. Be cautious if you see a large number of negative reviews or reports of harassment.

ALSO READ | DisComs' Pathetic Condition: Reason For India's Power Crisis

Privacy Policies:

- Verify if the app has a comprehensive privacy policy explaining how your data will be used and protected.

Use Security Software:

- Install reputable mobile security software to help identify and protect you from malicious apps.

Trust Your Instincts:

- If something feels too good to be true or the app's offers seem too generous, it might be a red flag for a fake app.

Report Suspicious Apps:

- If you suspect an app is fake or engaging in fraudulent activities, report it to the app store and relevant authorities.

Regularly Monitor Your Accounts:

- Keep an eye on your bank and financial accounts for any unauthorised transactions or suspicious activity.

Educate Yourself:

- Stay informed about common online scams and frauds. The more you know, the better equipped you are to spot potential threats.

Remember that scammers can be pretty sophisticated, so it's crucial to stay vigilant and sceptical, even when dealing with seemingly legitimate apps.

Suppose you encounter any suspicious behaviour or harassment. In that case, it's essential to promptly protect your personal and financial information.

Click here to find the list of 50 fake loan apps.

Stay Aler! Stay Protected!

Like this:

Like Loading...